The 45-Second Trick For Home Improvement Financing

Table of ContentsGet This Report on Home Improvement FinancingWhat Does Home Improvement Financing Do?

needed to have as much as a certain amount, yet it prevails for financial institutions to prepare lowests and also fee drawback fees. HELOC interest prices will definitely rely on your credit rating, loan-to-value ratio and also financing volume. Residence equity lines of credit possess an initial"draw period"(10 years most of the times), throughout which you may withdraw money. Monthly payment plannings within this time frame

differ. Some lending institutions enable you to begin paying for the money plus interest in month to month installations, or even rate of interest first, as well as capital funds by the end. What matters most is that you need to prepare to pay back any type of outstanding personal debt completely after the draw time period expires, whether through refinancing or even some various other methods. To determine their risk, financing service providers examine your debt past and also make use of either your FICO or even Advantage, Rating. If your credit report requires job, you can easily discover how to repair your credit scores or even look

Home Improvement Financing Things To Know Before You Buy

right into our listing of greatest debt fixing providers. Also the finest individual car loan passion rates may still be actually greater than for secured funding choices given that the lack of security or government insurance poses a much higher danger for the lending institution. For big property redesigns or lasting ventures, it's best to think about other loan alternatives. home improvement financing. varies every bank card type as well as provider Costs differ, but normal fees range coming from 16%to 24%No security needed0%APR introductory duration, Unlimited use, You.

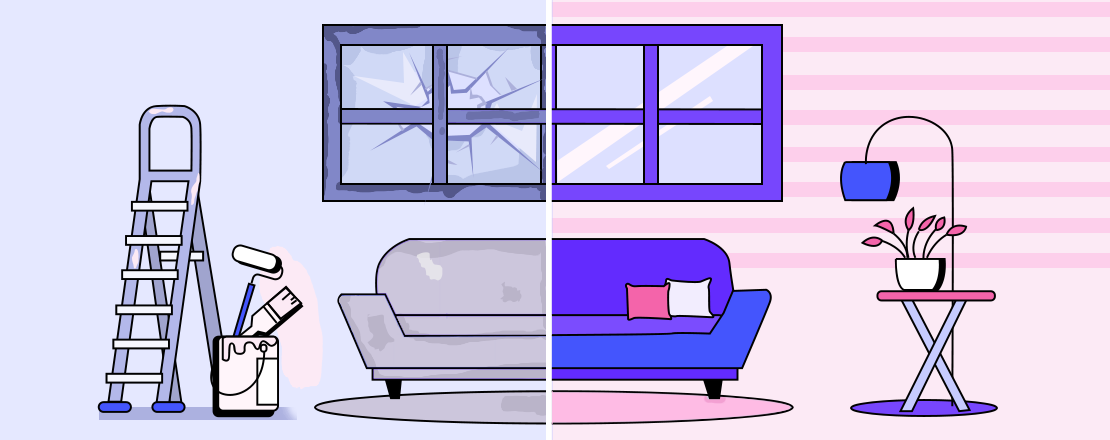

can use the line of credit as required, Achievable cashback rewards, Really high APR fees, High debt can come to be uncontrollable, Increases credit scores usage ratio, Utmost for simple, inexpensive fixings, Enthusiasms are certainly not tax-deductible To opt for the most ideal home renovation financing, examine your financial situation your credit document, credit history, credit rating, debt-to-income ratio, mortgage loan equity, and also income. Personal loans implied for property improvement can easily still be actually used for various other costs, needs to the need come up. The exact same puts on funds gotten by means of a cash-out re-finance , house equity product line of credit report, or house equity financing. Home improvement finances obtained via government finance programs are actually stricter. After satisfying qualifications criteria, pre-qualified contractors should create all fixings, as well as funds have to be actually used for property remodelings, as specified and also accepted due to the loan provider and FHA (home improvement financing).Everyone can spend for residence improvements in cash in an optimal globe, but repairs are actually typically thus pricey that a car loan is actually the only possibility. A perk is actually check these guys out that there are actually no security demands and also no make use of stipulations. Review your financial information closely to establish which house renovation financing alternative fits greatest. Essentially, a property renovation planning should pay for on its own down the road, raising the value of your property and also supporting your general lifestyle. A property improvement car loan jobs through giving the loan you require to maintain, restore or even strengthen your house. You can easily decide on various sorts of funding for your venture, so contrast your possibilities carefully to discover the pros and drawbacks of each. A property remodeling car loan isn't a certain form of loan. Unprotected financings don't need collateral and also include personal loans and bank card. While you don't possess to put your resources vulnerable to remove an unsecured car loan, they might be harder to get or deliver much less positive terms. Choosing how to pay for your home improvement job may depend on the form of work you intend to carry out, your task's timetable as well as your credit reliability. If you require a lending rapidly, do n't wish to use your property as collateral or do not have a lot equity, an unsecured private car loan can be most ideal. If you're up for an extra detailed application procedure, you are comfy utilizing your house as collateral, and also you've developed good enough equity to qualify, a protected lending may provide a lower interest fee. Discuss this story, Opinion, With itinerary largely in out there over the past 18 months as well as numerous Americans still unclear of the protection of venturing out, some have actually transformed their interest instead to enhancing the residences where they're increasingly spending their time. Renovating your residence may certainly not just produce it a lot more delightful to stay inside your home, it can easily improve the residence's value as well as come to be a profitable assets in the long-term

There's the concern of opting for the remodelling project itself, followed through determining exactly how much to spend and also, if needed, how to fund it. Costs for a well-done job could be steep. home improvement financing. An improvement may be actually within grasp with a number of lending options, featuring savings, a property equity pipe of credit score(HELOC), a construction loan and debt memory cards."The pleasant location for home kitchen [renovations] tends to be around 10 percent of the list price of the house, and also for restrooms it's about one-half that, "mentioned Mischa Fisher, main economic expert at Angi, a house services system. The downside to that is actually the high price of lumber and other problems that create the ventures less possible than they otherwise would certainly be."Still, a with taste carried out restoration can deliver a good profit on assets. Besides the ever-popular bathroom and kitchens, improving the perspective constantly helps. "The very best payoffs Get More Information tend to be actually big aesthetic adjustments for a moderate cost, things like exterior tasks along with visual charm,"mentioned Fisherman. It can cost you upwards go to the website of$ 10,000 upfront however is actually